Homeowners Insurance in and around Long Island City

Looking for homeowners insurance in Long Island City?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

Everyone knows having excellent home insurance is essential in case of a hailstorm, blizzard or fire. But homeowners insurance is about more than covering natural disaster damage. One important part of home insurance is that it also covers you in certain legal cases. If someone slips at your residence, you could be held responsible for their medical bills or physical therapy. With good home coverage, these costs may be covered.

Looking for homeowners insurance in Long Island City?

Apply for homeowners insurance with State Farm

State Farm Can Cover Your Home, Too

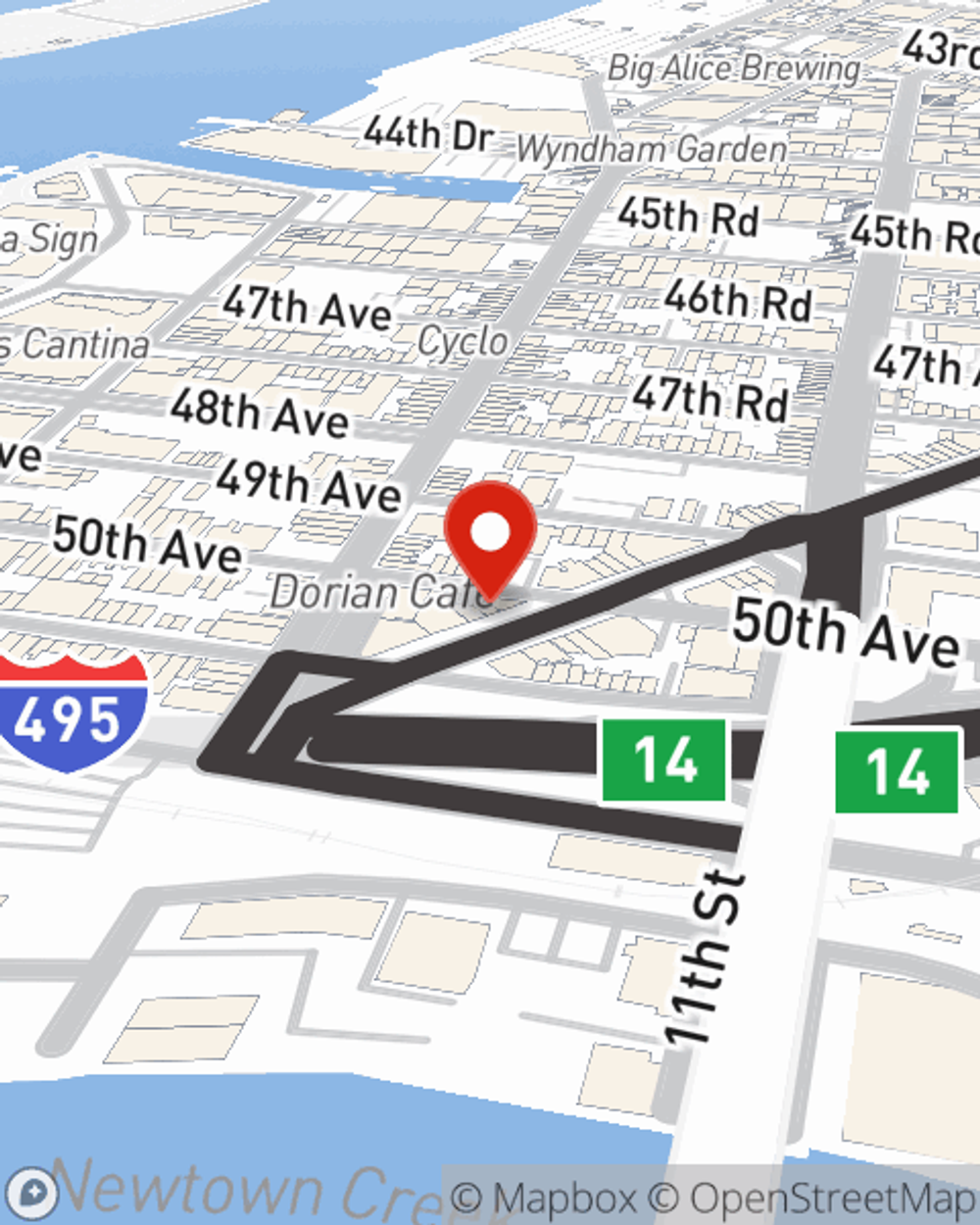

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Mike Winter can be there whenever mishaps occur, to get your homelife back to normal. State Farm is there for you.

As a reliable provider of home insurance in Long Island City, NY, State Farm aims to keep your belongings protected. Call State Farm agent Mike Winter today for a free quote on a home policy.

Have More Questions About Homeowners Insurance?

Call Mike at (718) 707-0075 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Mike Winter

State Farm® Insurance AgentSimple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.